PPT 公司治理 Shleifer & Vishny (1997,JF) PowerPoint Presentation ID3898448

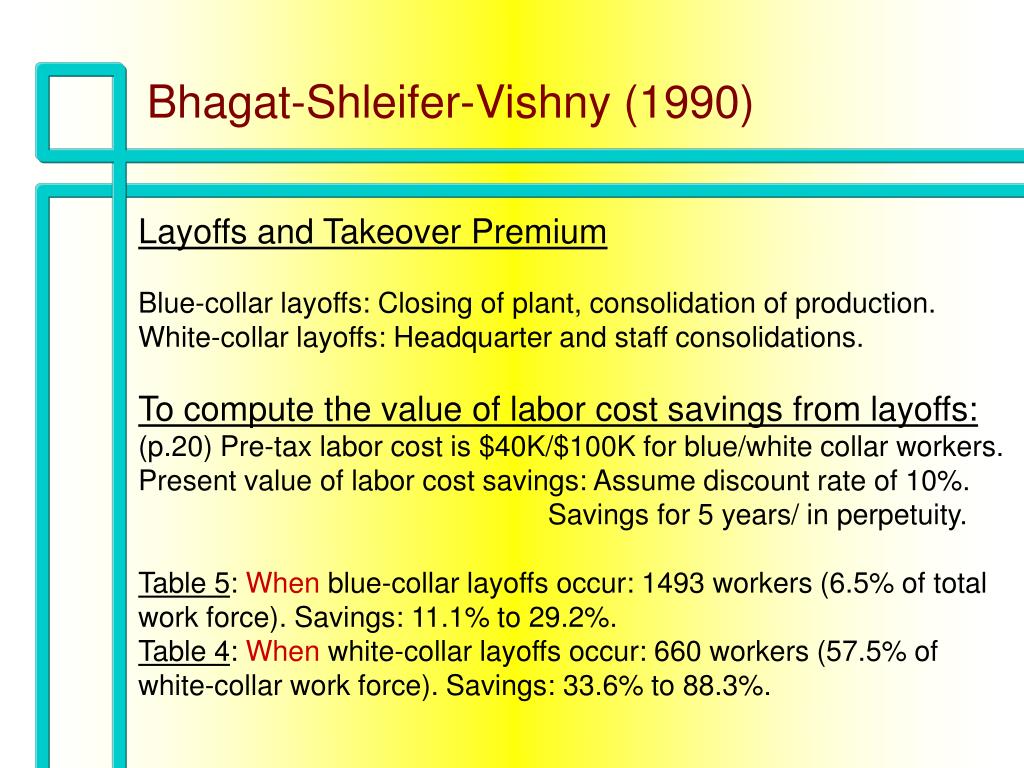

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

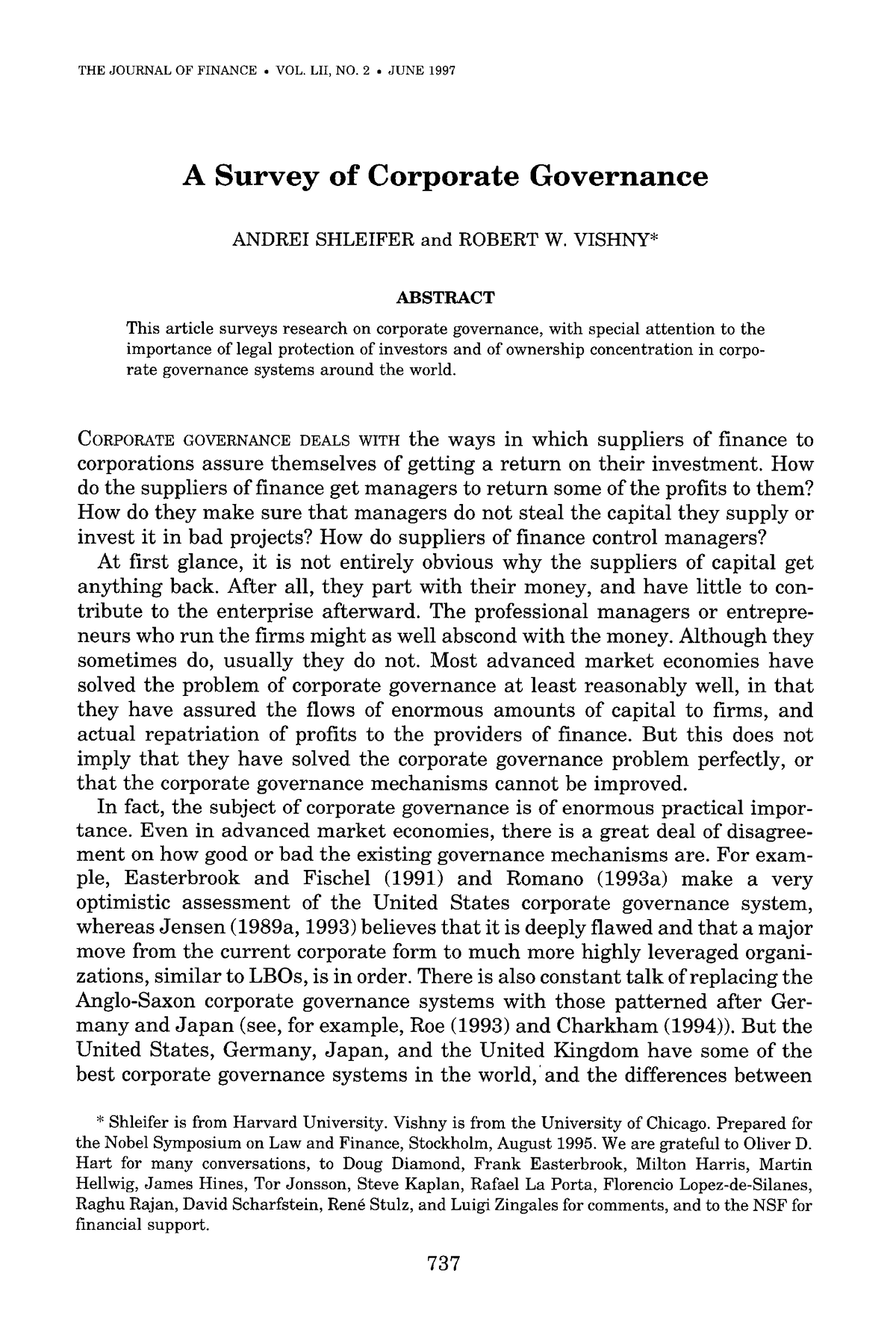

See all articles by Andrei Shleifer Andrei Shleifer. Harvard University - Department of Economics; National Bureau of Economic Research (NBER); European Corporate Governance Institute (ECGI). No. 2, 1997 Posted: 23 Jun 1998. Date Written: April 1996.. Suggested Citation. Shleifer, Andrei and Vishny, Robert W., A Survey of Corporate.

A model of investor sentiment Barberis, Shleifer & Vishny Journal of Financial Economics,1998

A Survey of Corporate Governance. Andrei Shleifer & Robert W. Vishny. Working Paper 5554. DOI 10.3386/w5554. Issue Date April 1996. This paper surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corporate governance systems around the world.

The Limits to Arbitrage Shleifer and Vishny FINA 4329 StuDocu

LaPorta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W Vishny. 1997. "Trust in Large Organizations." American Economic Review Papers and Proceedings 87 (2): 333-338.

Основы Корпоративного Управления к э н преп

A Survey of Corporate Governance Citation Shleifer, Andrei, and Robert W. Vishny. 1997. A Survey of Corporate Governance. The Journal of Finance 52, no. 2: 737-783.

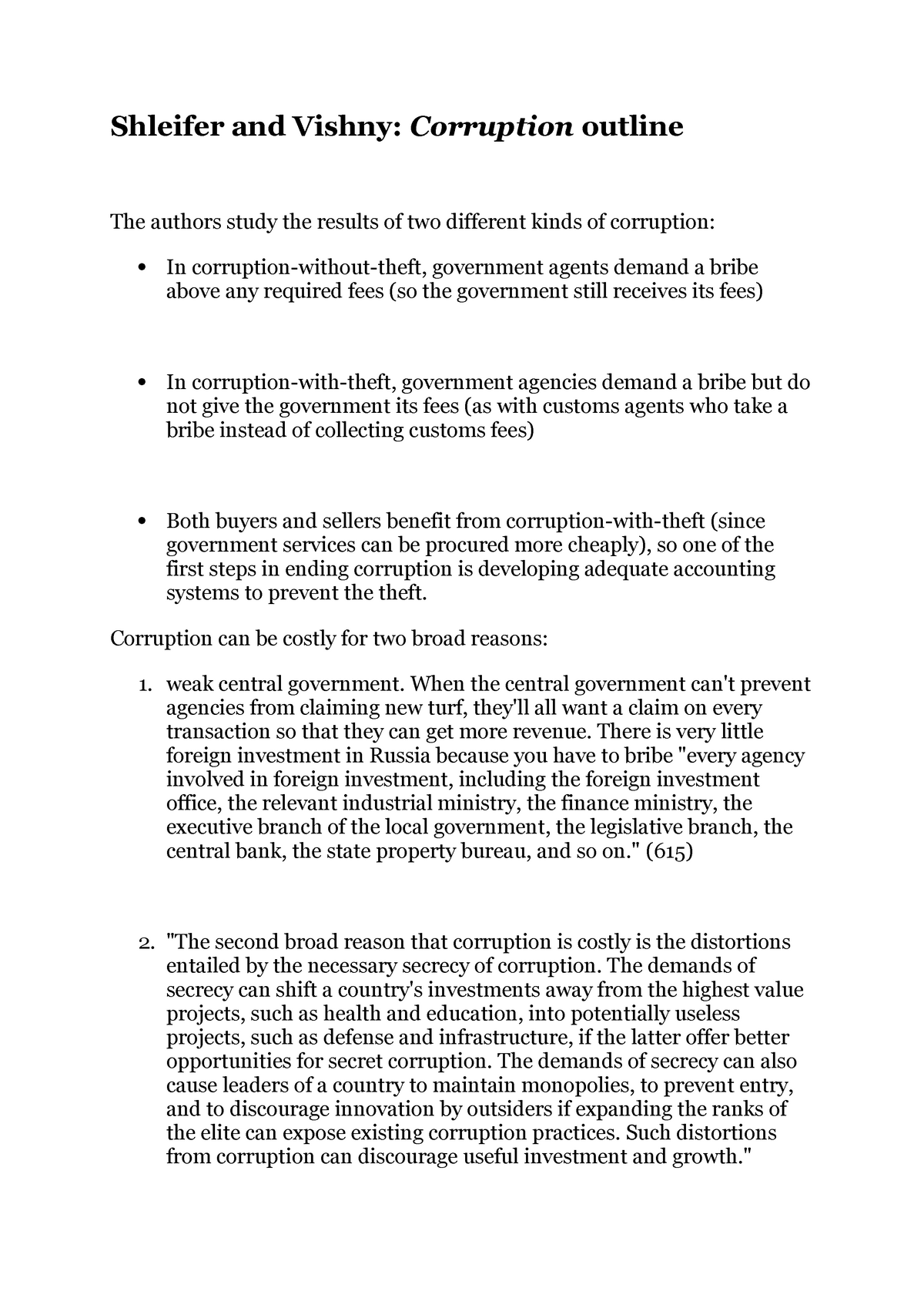

Shleifer and Vishny Summary Corruption Shleifer and Vishny Corruption outline The authors

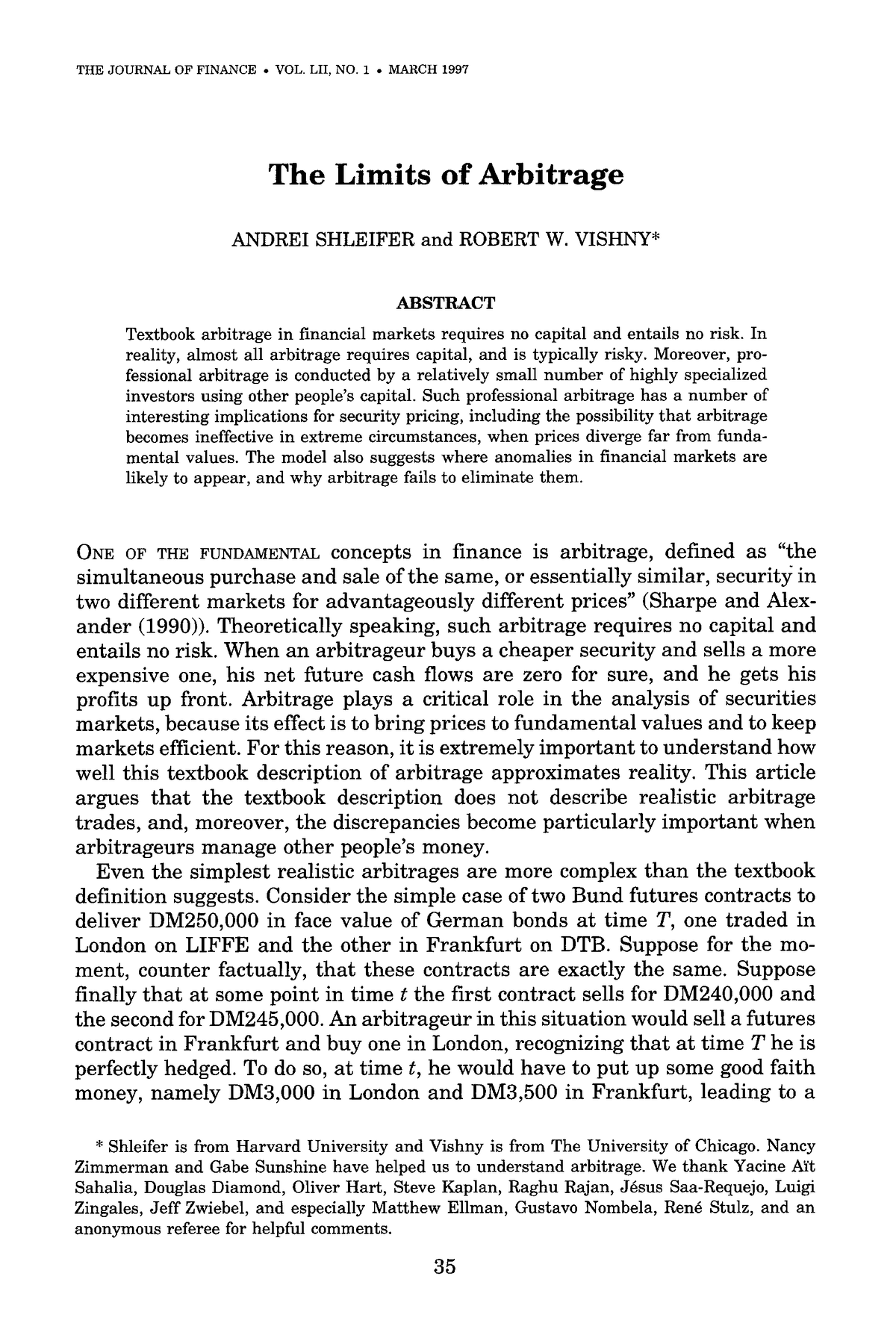

Shleifer, Andrei, and Robert W Vishny. 1997. "The Limits of Arbitrage." Journal of Finance 52 (1): 35-55.

Limits of Arbitrage by Shleifer Vishny The Limits of Arbitrage Author(s) Andrei Shleifer and

ROBERT W. VISHNY. La Porta, Lopez-de-Silanes, and Shleifer are from Harvard University, and Vishny is from the University of Chicago. We are grateful to Alex Chang, Mark Chen, and Magdalena Lopez-Morton for research assistance, to Ed Glaeser, Stewart Myers, and Luigi Zingales for helpful comments, and to the HIID and the National Science Foundation for support of this research.

(PDF) Anything is Possible On the Existence and Uniqueness of Equilibria in the ShleiferVishny

A Survey of Corporate Governance. Andrei Shleifer, Robert W. Vishny. 31 May 1997 - Journal of Finance (Wiley-Blackwell) - Vol. 52, Iss: 2, pp 737-783. TL;DR: Corporate Governance as mentioned in this paper surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership.

Parameters for the MurphyShleiferVishny Models Download Table

Reprinted in Robert Cooter and Francesco Parisi, eds., Recent Developments in Law and Economics, Edward Elgar Publishing Company, 2010. Shleifer, Andrei, and Robert W Vishny. 1997. "A Survey of Corporate Governance.". Journal of Finance 52 (2): 737-783.

委托—代理视角下的跨国公司海外子公司人员外派动因理论探析_word文档在线阅读与下载_免费文档

A Survey of Corporate Governance. Andrei Shleifer, Robert W. Vishny. Published 1 April 1996. Business, Law, Economics. Organizations & Markets eJournal. This article surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corporate governance systems.

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

THE JOURNAL OF FINANCE . VOL. LII, NO. 2 . JUNE 1997 A Survey of Corporate Governance ANDREI SHLEIFER and ROBERT W. VISHNY* ABSTRACT This article surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corpo-rate governance systems around the world.

2 15 pts in the murphyshleifervishny big push model suppose there are 100 indus StudyX

Andrei Shleifer!,*, Robert Vishny#!Department of Economics, Harvard University, Cambridge, MA 02138, USA. 1997, 1998). When investor rightssuch as the voting rights of the shareholders and the reorganization and liquidation rights of the creditors are extensive and well enforced by regulators or courts,

Shleifer 19972 the article is related to a survey of corporated go THE JOURNAL OF FINANCE

Robert W. Vishny. Shleifer is from Harvard University. Vishny is from the University of Chicago. Prepared for the Nobel Symposium on Law and Finance, Stockholm, August 1995.. June 1997. Pages 737-783. References; Related; Information; Close Figure Viewer. Return to Figure. Previous Figure Next Figure. Caption. Download PDF.

Muhammad Tamrin 2017 In their classic survey of corporate governance, Shleifer & Vishny (1997

Shleifer is from Harvard University and Vishny is from The University of Chicago. Nancy Zimmerman and Gabe Sunshine have helped us to understand arbitrage. We thank Yacine Aït Sahalia, Douglas Diamond, Oliver Hart, Steve Kaplan, Raghu Rajan, Jésus Saa-Requejo, Luigi Zingales, Jeff Zwiebel, and especially Matthew Ellman, Gustavo Nombela, René.

The Grabbing Hand Government Pathologies and Their Cures (9780674010147) Andrei Shleifer and

Created Date: 20060227160045Z

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

14 Shleifer and Vishny (1997) obs erve that "the take over solution practised in the United States and the . United Kingdom, then, is a very imperfect a nd politically vulnerable method of.

La Porta, R., F. LopezdeSilanes, A. Shleifer, and R. W. Vishny. 1997. “Legal Determinants of

Shleifer and Vishny (1997) and LLSV (1996) focus on the legal solutions to agency problems between entrepreneurs and investors, and in particular emphasize the cross country differences in these solutions. Modigliani and Perotti (1996) also focus on contract enforcement as a determinant of external finance, and in particular stress the choice.