Using a trend correctly when trading

Higherhighs And Higherlows The Complete Guide (UPDATED)

A bullish divergence is signaled when the RSI indicator has an oversold reading then a higher low that correlates to lower lows in the price action. This can show increasing bullish momentum, a break out back above an oversold reading is a common buy parameter used to signal a new long position.

Ultimate guide to Higher High Lower Low Trading Strategy Learn Forex Trading and foreign

The HHLLS (Higher High Lower Low Stochastic) study is a momentum-based technical indicator developed by Vitali Apirine. It consists of two stochastic lines, the calculation of which is inspired by StochasticFull and Williams%R. The main purpose of HHLLS is to recognize trend behavior: emergence, corrections, and reversals.

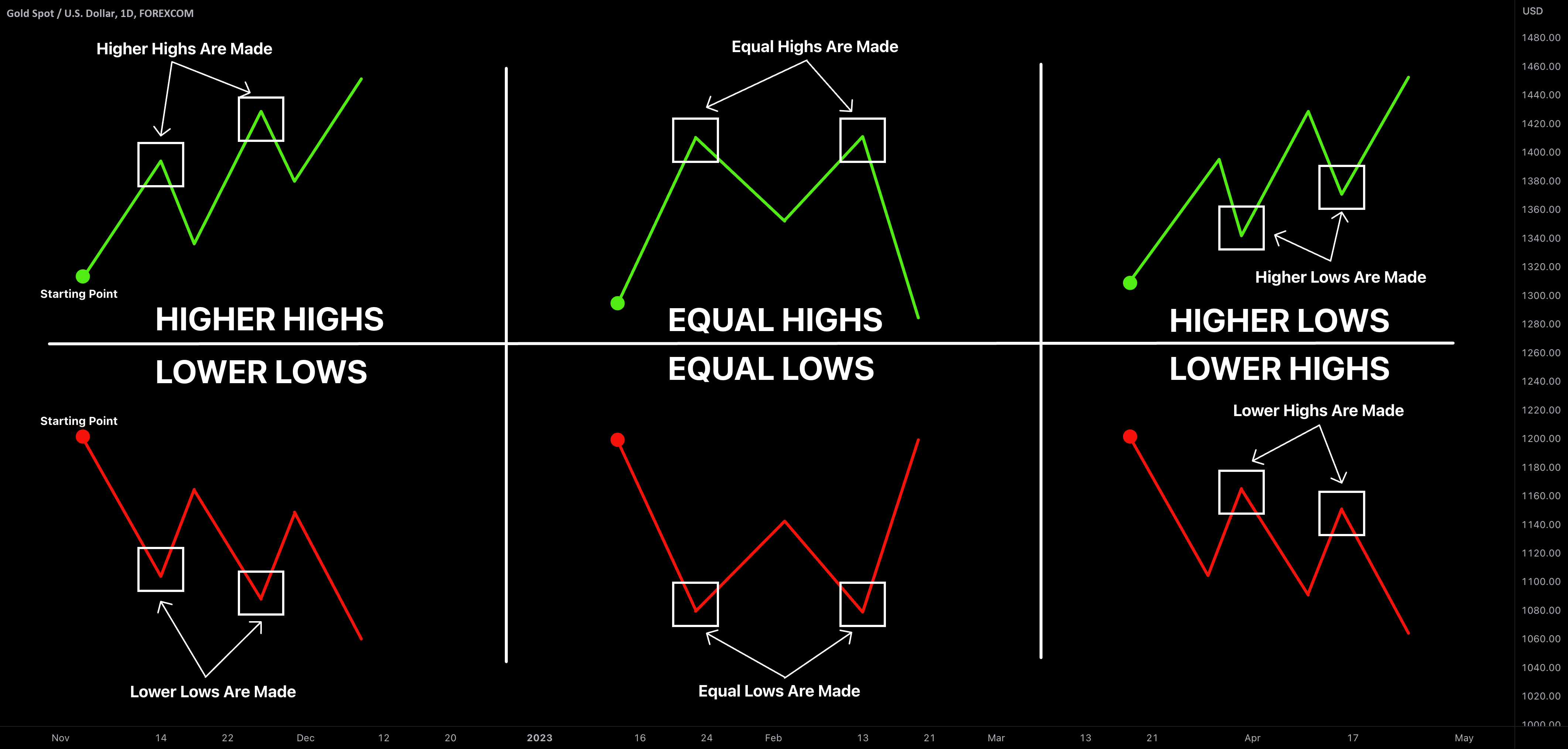

What is Higher High, Higher Low, Lower Low, Lower High for by VasilyTrader

In this Trading Basics video, we will explain the concept of lower lows and higher highs in technical analysis, which is a common technique used by many trad.

High Low Vector Art, Icons, and Graphics for Free Download

Divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. There are two types of divergences: Regular divergence Hidden divergence Each type of divergence will contain either a bullish bias or a bearish bias.

Cutting through the noise analyzing price action correctly

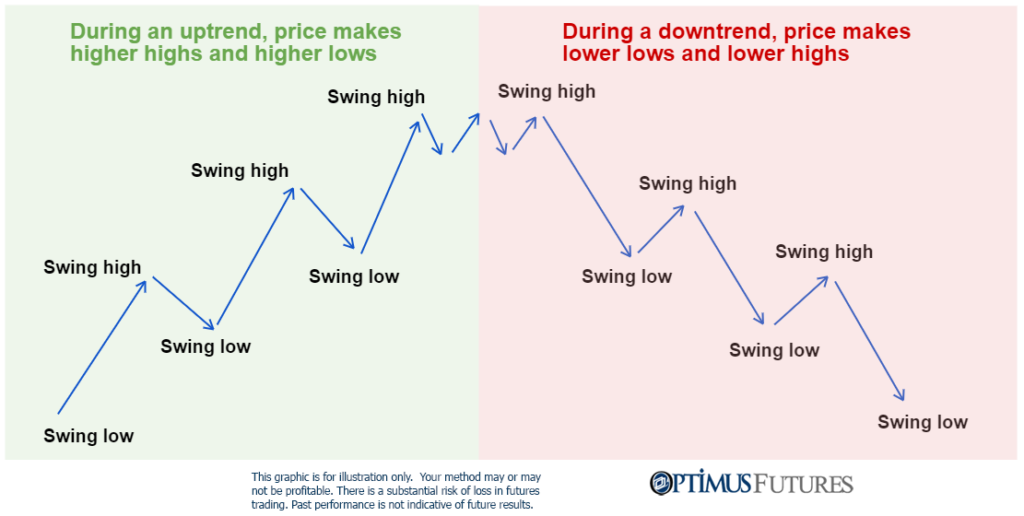

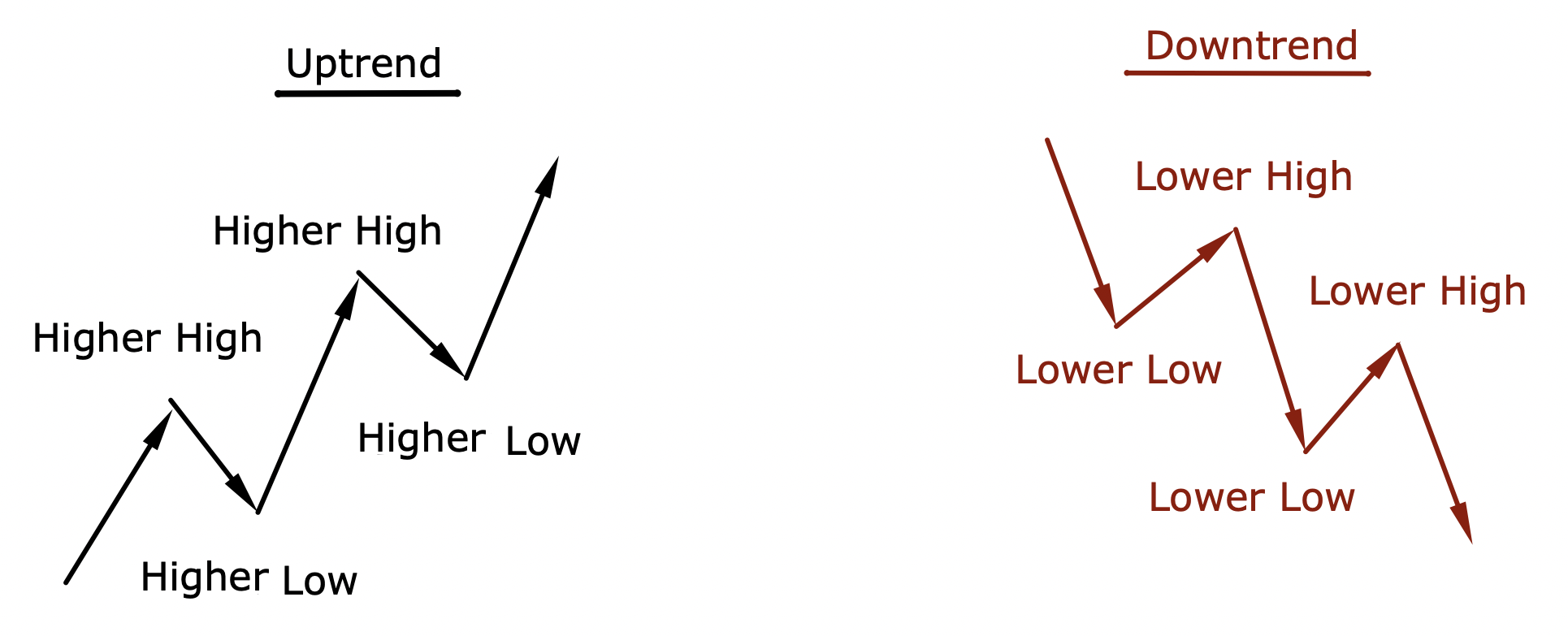

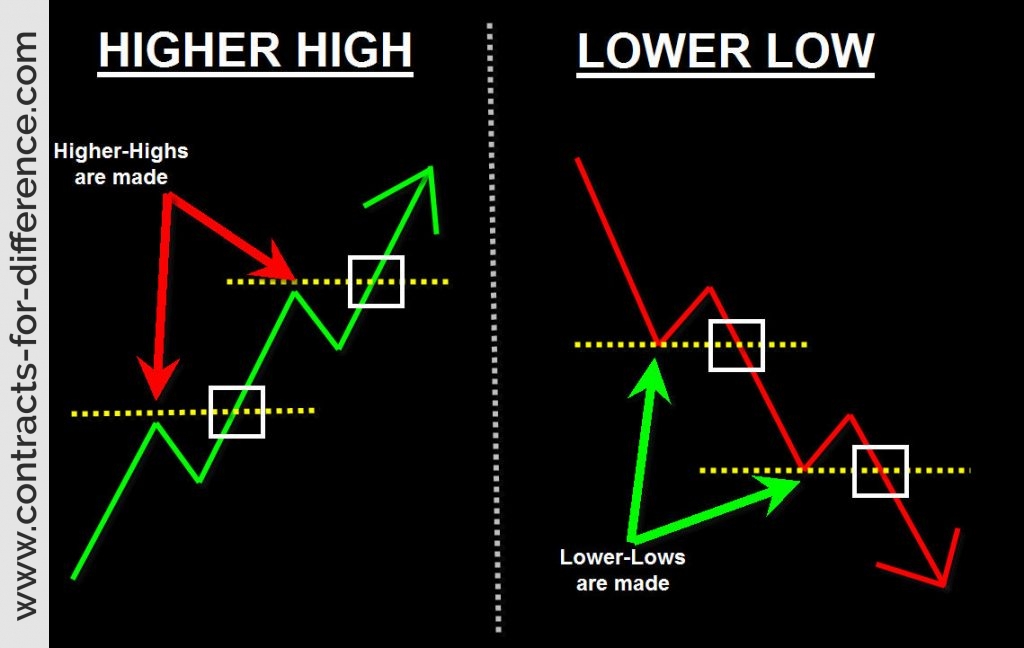

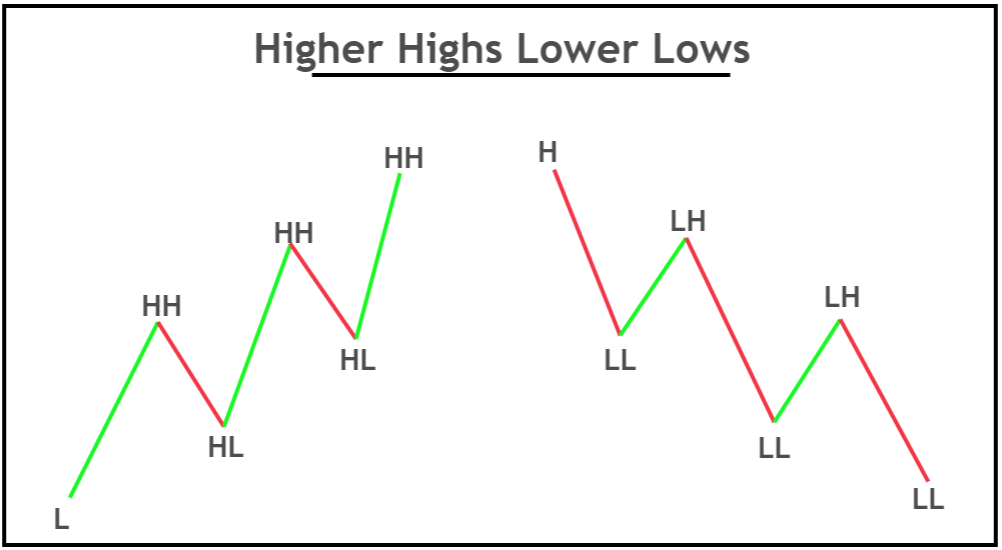

A "higher low" occurs when the price of a currency pair reaches a new low that is higher than the previous low, without being preceded by a lower low. These price movements can indicate a bullish trend and can be used as a trading signal. How Higher Highs & Higher Lows Create Bullish Trends

Using a trend correctly when trading

A "lower high" occurs when the price of a currency pair reaches a high that is lower than the previous high, followed by a downward price movement. A "lower low" occurs when the price of a currency pair reaches a low that is lower than the previous low, followed by a downward price movement.

Higher Highs And Lower Lows 📈 📉 Your Guide To Understanding Uptrends And Downtrends Margex

Lower highs and lower lows mean the low and high of the recent candlestick is lower than the lower and high of the previous candlestick. The formation of consecutive lower lows and lower highs in the price of a currency during a specific timeframe is referred a bearish trend in forex trading.

TradingView Higher High Lower Low Indicator Best Indicators For Options Trading Live Trading

What are Higher High, Higher Low, Lower High and Lower Low in Forex | Explained | Swing High Low Traders Monopoly 26K subscribers Subscribe Subscribed 37K views 2 years ago.

HIGHER HIGH, LOWER LOW, TREND LINE TRADING STRATEGY FOR BEGINNER, how to do technical analysis

When the price breaks out of a consolidation or trading range, forming a new higher high or lower low, it often signals the beginning of a new trend. Traders can take advantage of these breakouts by entering trades in the direction of the emerging trend. Conversely, when highs and lows fail to form, it may indicate a potential trend reversal.

Day Trading in the UK How to Get Started My Trading Skills

Register in 2 Steps When identifying downwards asset value trends they use a very similar technique: Lower low: If the price of a security closes at a lower price than it did at the close of the previous day, which was also a low, then it is referred to as a lower low.

Higher Highs And Lower Lows 📈 📉 Your Guide To Understanding Uptrends And Downtrends Margex

July 1, 2022 by David Roads There are many trading strategies, but the higher high lower low method is the most effective one. You can trade using this strategy in any type of financial market like forex, stock, crypto. What is Higher High and Lower Low

what is higher high & higher low and lower low & lower high in the stock market? Complete guide

The higher highs and higher lows pattern signals an uptrend. Is this likely to continue or reverse? In almost all markets, the higher high and higher low pattern signals weak future short-term gains. Unfortunately, it doesn't work as a short strategy. Table of contents: The higher highs and higher lows pattern

Higher Highs And Lower Lows

The lower highs and lower lows pattern - strategy 1 The first column shows the holding period in days. The first row shows that if we exit on the next day's close the average is 0.09%. If we exit after two weeks (ten trading days), the average increases to 0.47%.

Higher High Lower Low Trading Strategy

A Higher High/Lower Low is a popular trading strategy based on identifying trends in a stock's price movements. It involves looking for higher highs and lower lows to determine the overall direction of the stock. Earn up to $1000 on Binomo! Use a. BLOG80.

Forex Edge Finder Strategy Excel With Forex Trend Analysis

Lower High Lower Low. Lower High Lower Low is a technical pattern widely used in forex trading to identify potential trend reversals and forecast future price movements. This pattern occurs when the price of a currency pair forms a series of lower highs and lower lows, indicating a shift in market sentiment from bullish to bearish.

Ultimate guide to Higher High Lower Low Trading Strategy Learn Forex Trading and foreign

Lower high: Lower highs are formed when the price of the security closes higher for the day but sustains below the previous high of the market. This gives the individuals an indication that the upper trend is dipping the market and the price of the security can likely decline in the future.