Free Audio Service Manuals Free download Akai AAV 205 Service Manual

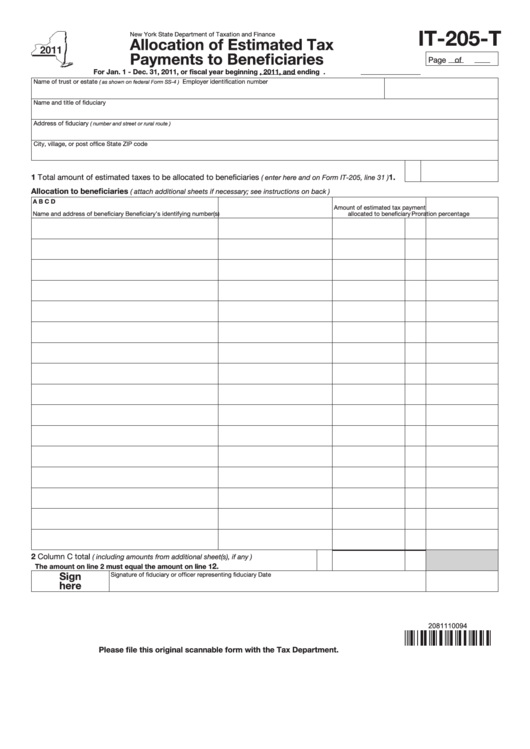

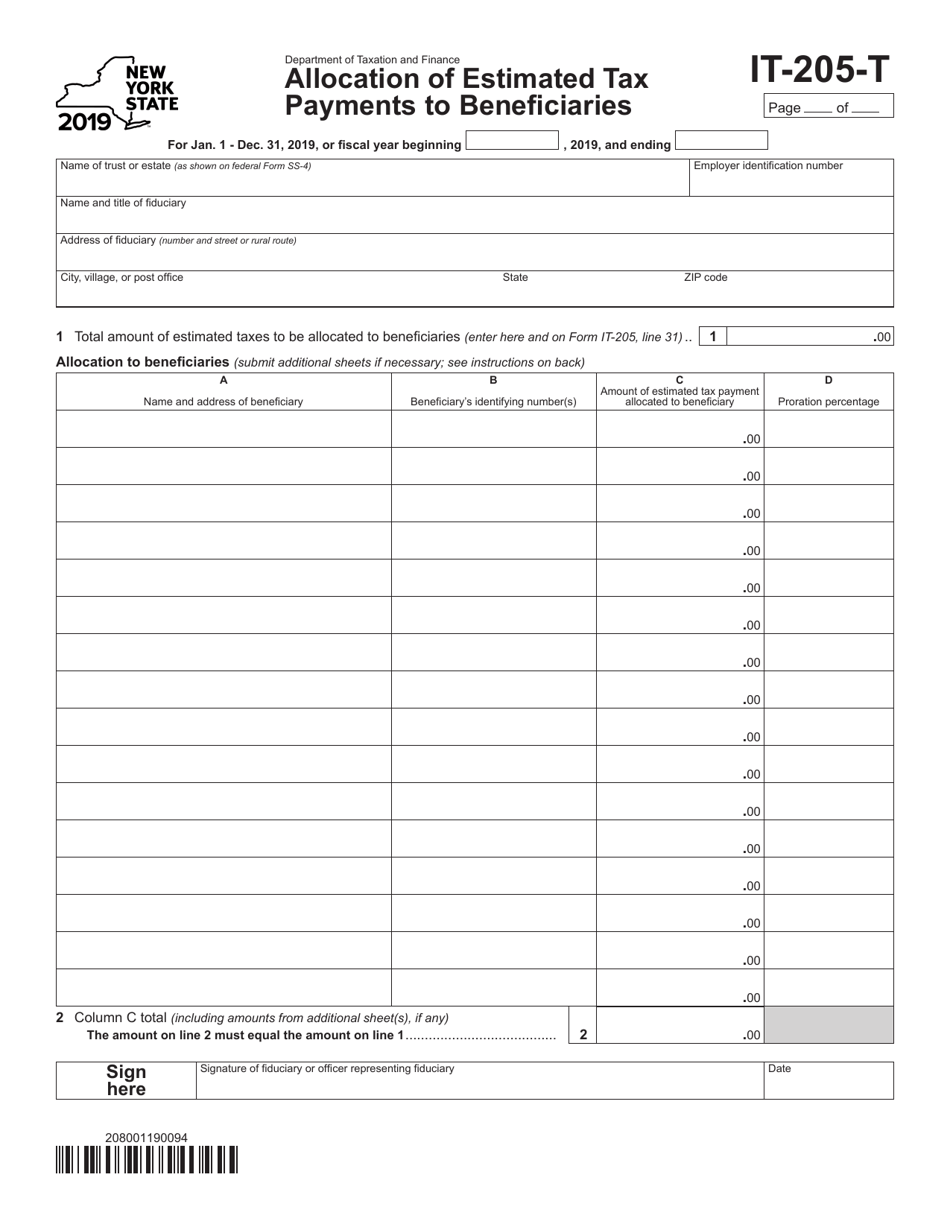

Fillable Form It205T Allocation Of Estimated Tax Payments To

To mark residency status for NYC on IT-205: Go to Screen 2.1, Miscellaneous Information. Scroll to New York Miscellaneous section. Enter a 4 or 5 in, NYC 4=full year, 5=part-year (code 102) under Residency Status subsection. This entry checks the appropriate box on Form IT-205, page 2 and determines the need to file Form IT-205-A for a New York.

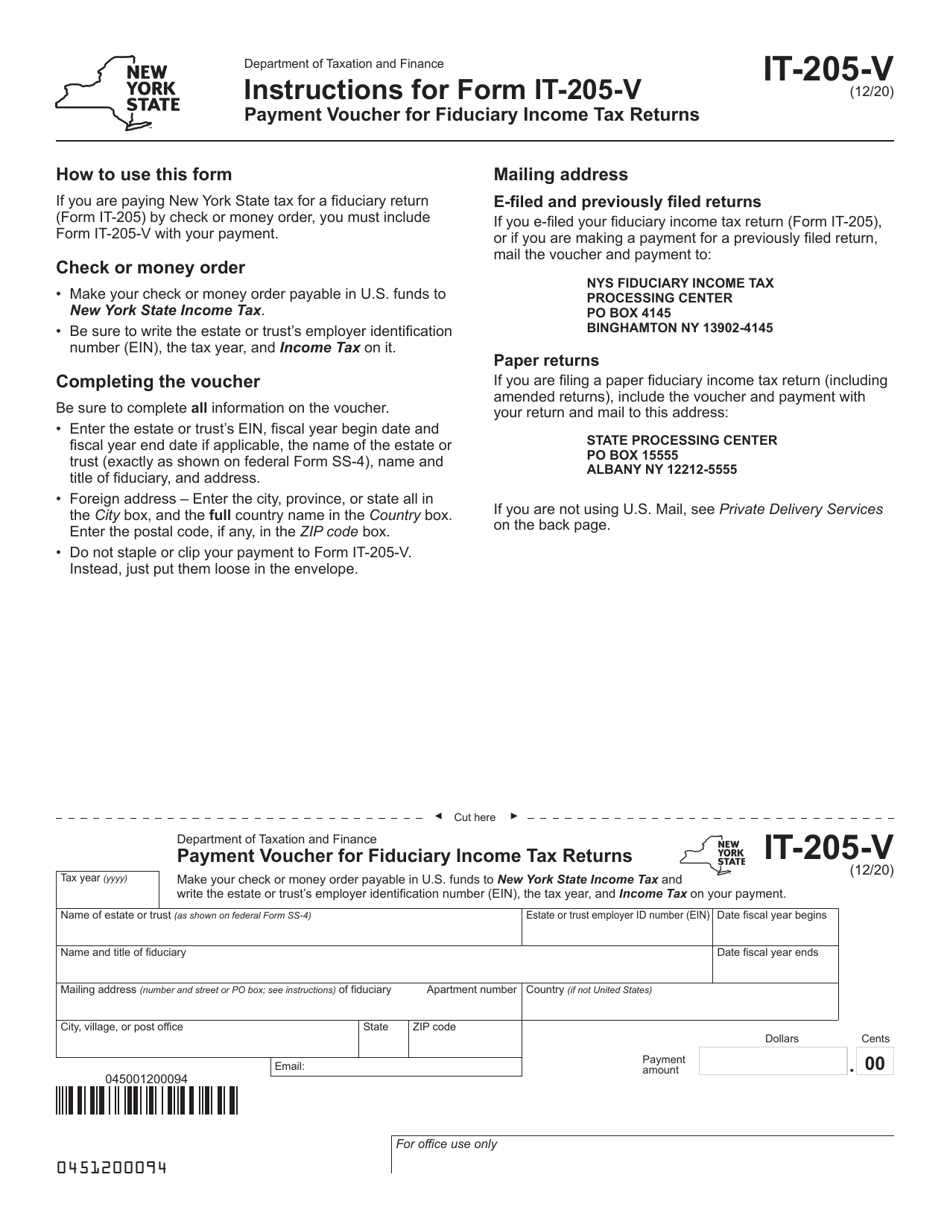

Form IT205V Download Fillable PDF or Fill Online Payment Voucher for

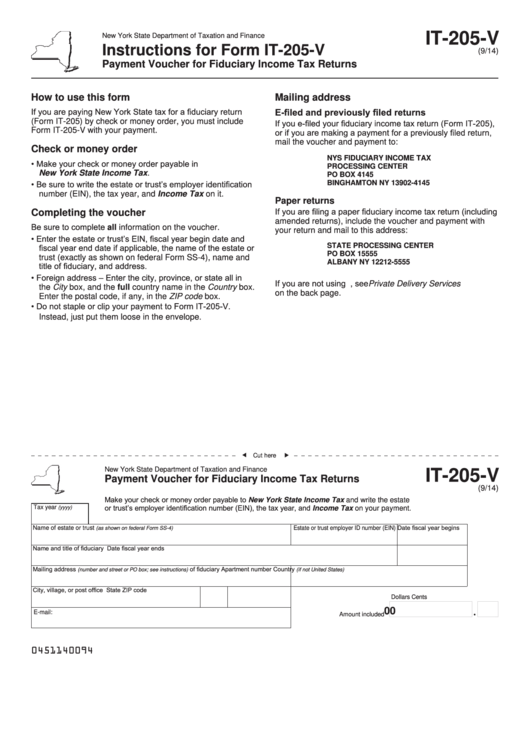

IT-205-V (12/23) Department of Taxation and Finance Instructions for Form IT-205-V Payment Voucher for Fiduciary Income Tax Returns When to use this form b. Enter the full country name in the Country box. Do not abbreviate. c. Enter the postal code, if any, in the ZIP code box. 4.

IT 205S ULTRASTAB Lem Current Transducer, IT xx5 Series, 200A

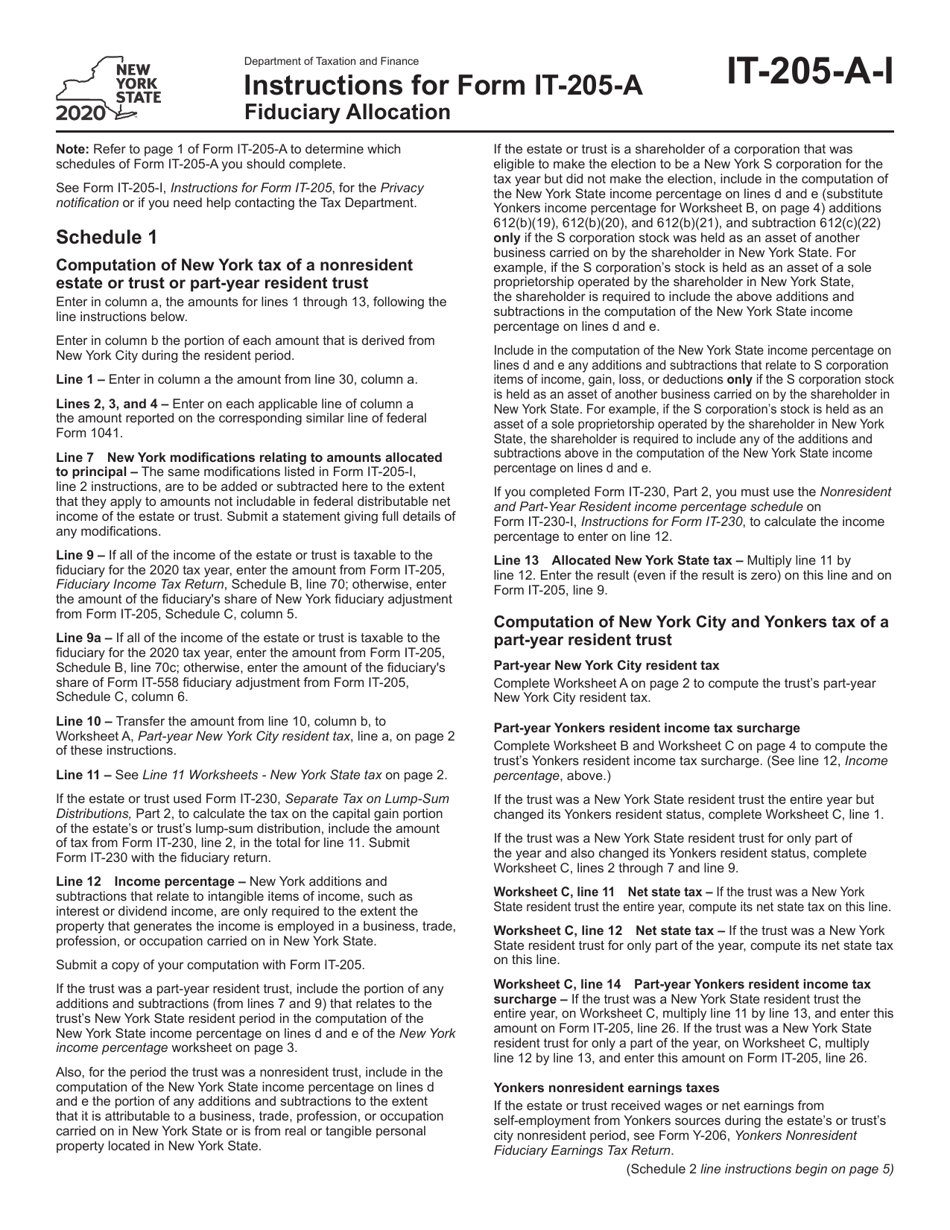

Instructions for completing the various schedules of this form can be found in Form IT-205-A-I, Instructions for Form IT‑205‑A. Schedule 1 - Computation of New York tax of a nonresident estate or trust or part-year resident trust a b Total federal Amount from New York City amount resident period

Garmin Nuvi 205 Instructions Manual

— Complete Schedules 2, 3, and 4 of Form IT-205-A and any of Schedules 5, 6, 7, and 8 of Form IT-205-A that apply, unless . none . of the income distributable to the nonresident beneficiaries is derived from . New York State . sources. In this case, Form IT-205-A does not need to be completed even though . other. income is distributable to.

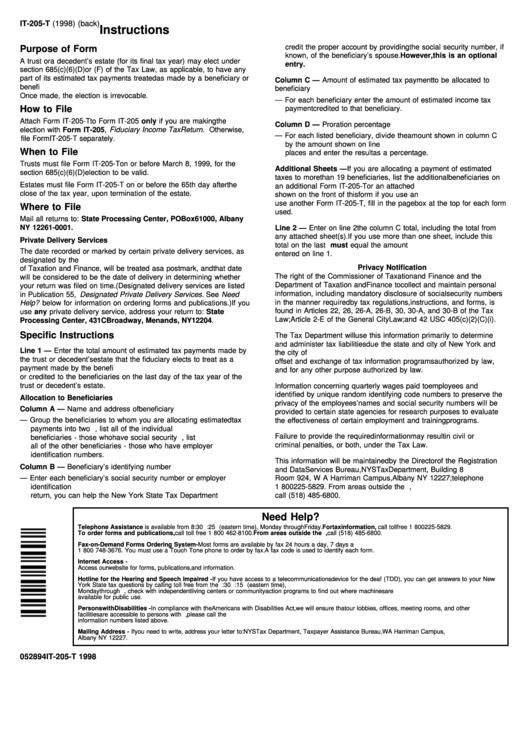

Instructions For Form It205T Allocation Of Estimated Tax Payments

Form IT-205-A, Fiduciary Allocation, must be completed and attached to a Form IT-205 that is filed for (1) a nonresident estate or trust having income derived from New York State sources, (2) a part-year resident trust, or (3) a resident estate or trust with a New York State nonresident beneficiary (except as noted under

It 205 final exam

New York State Department of Taxation and Finance IT-205-IInstructions for Form IT-205 Change of New York State residence of trustFiduciary Income Tax Return If the person whose property constitutes aNew York State • City of New York • City of Yonkers revocable trust has changed his or her domicile from or to New York State, betweenGeneral instructions nonresident beneficiary (except as.

EBECO EBTHERM 205 MANUAL Pdf Download ManualsLib

Fiduciary Income Tax Return Form IT-205 Fiduciary Income Tax Return Tax Year 2023 IT-205 Department of Taxation and Finance Fiduciary Income Tax Return New York State • New York City • Yonkers Type of entity from Form 1041: Decedent's estate Simple trust Complex trust Qualified disability trust ESBT (S portion only) Grantor type trust Bankruptcy estate-Ch. 7 Bankruptcy estate-Ch. 11.

Free Audio Service Manuals Free download Akai AAV 205 Service Manual

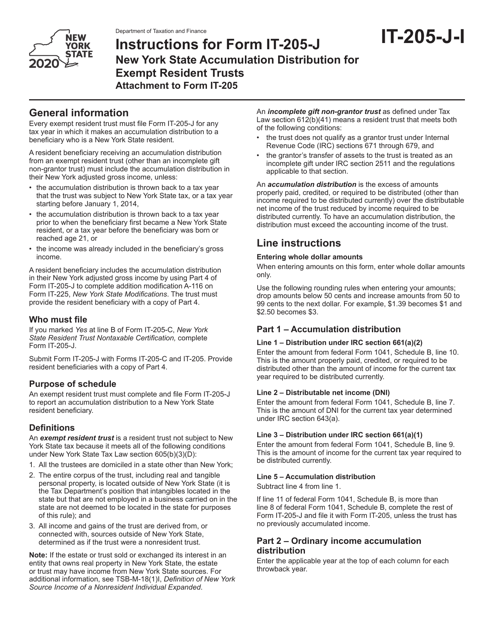

If you marked Yes at line B of Form IT-205-C, New York State Resident Trust Nontaxable Certification, complete Form IT-205-J. Submit Form IT-205-J with Forms IT-205-C and IT-205. Provide resident beneficiaries with a copy of Part 4. Purpose of schedule An exempt resident trust must complete and file Form IT-205-J

GPS205 User manual Uniden GPS 205 Manualzz

See Form IT-205-I, Instructions for Form IT-205, for assistance. 205002230094 Page 2 of 4 IT-205 (2023) Schedule A Details of federal taxable income of a fiduciary of a resident estate or trust - Enter items as reported for federal tax purposes or submit federal Form 1041. Submit a copy of federal Schedule K-1 (Form 1041) for each beneficiary.

Form IT205T Download Fillable PDF or Fill Online Allocation of

Line 9 - If all of the income of the estate or trust is taxable to the fiduciary for the 2023 tax year, enter the amount from Form IT-205, Fiduciary Income Tax Return, Schedule B, line 70; otherwise, enter the amount of the fiduciary's share of New York fiduciary adjustment from Form IT-205, Schedule C, column 5.

TELEFUNKEN R 205 SM Service Manual download, schematics, eeprom, repair

IT-205-C Department of Taxation and Finance New York State Resident Trust Nontaxable Certification Tax Law - Article 22, Sections 605(b)(3)(D) and 658(f)(2) To be filed with Form IT-205 when a trust meets the conditions of Tax Law section 605(b)(3)(D); see instructions (Form IT-205-I) Name of trust Employer identification number (EIN) Mark an.

Download Instructions for Form IT205J New York State Accumulation

If you are a fiduciary of a New York State resident estate or trust, you may need to file fiduciary tax forms. Find the current year forms and instructions on this webpage, such as Form IT-205, Form IT-205-A, and Form IT-205-C.

Wzmacniacz KEYENCE EX205 • Cena, Opinie • Czujniki i przetworniki

IT-205-J (Fill-in) IT-205-J-I (Instructions) New York State Accumulation Distribution for Exempt Resident Trusts: IT-205-T (Fill-in) Instructions on form: Allocation of Estimated Tax Payments To Beneficiaries: IT-205-V (Fill-in) Instructions on form: Instructions and Payment Voucher for Fiduciary Income Tax Returns: IT-209 (Fill-in) IT-209-I.

Peugeot 205 Users Manual

IT-205-V Who must use a payment voucher? If you e-filed your New York State fiduciary income tax return (Form IT‑205) and you owe tax, you must submit this payment voucher, Form IT-205-V below, if you pay by check or money order. Also use Form IT-205-V if you have previously filed your fiduciary income tax return (Form IT-205) and want to make a

Download Instructions for Form IT205A Fiduciary Allocation PDF, 2020

service for instructions on how to obtain written proof of the date your form was given to the delivery service for delivery. If you use any private delivery service, whether it is a designated service or not, and you e-filed Form IT-205, send Form IT-205-V and your payment to: JPMorgan Chase, NYS Tax Processing - Estimated Tax, 33 Lewis Rd.,

Fillable Form It205V Payment Voucher For Fiduciary Tax

Form IT-205-A, Fiduciary Allocation, must be completed and submitted with a Form IT-205 that is filed for (1) a nonresident estate or trust having income derived from New York State sources, (2) a part-year resident trust, or (3) a resident estate or trust with a New York State nonresident beneficiary (except as noted under