CRA Mileage Rate For SelfEmployed Canadians 2022 Guide

Section E Mileage Allowance P11d goselfemployed.co

The Canada Revenue Agency (CRA) provides mileage rates and reasonable automobile allowances for those who need to use their personal vehicles for work-related purposes. This includes motor vehicle expenses for transportation, travel, or other related business activities.

CRA Mileage Rate For SelfEmployed Canadians 2022 Guide

The 2021 reasonable vehicle allowance rate per kilometre (km) is as follows: 59¢ per km for the first 5,000 km driven. An additional 4¢ per km driven in the Northwest Territories, Nunavut, and Yukon. Find the latest kilometre rates for your province or territory here, as well as the vehicle mileage rates for previous years.

Mileage Reimbursement Allowance in Canada CRA (2023) PiggyBank

The limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes in the provinces will increase by seven cents to 68 cents per kilometre for the first 5,000 kilometres driven, and to 62 cents for each additional kilometre.

CRA Auto Allowances IRS Mileage Rates

In provinces, the limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes will increase by two cents, to 70 cents per kilometre, for the first 5,000 kilometres driven, and to 64 cents for each additional kilometre.

How To Claim CRAapproved Mileage Deductions in Canada

The rate set by the CRA for 2023 currently stands at $0.68 per kilometre for business travel for the first 5,000 kilometres and $0.62 thereafter for all provinces. The rate for all territories is set at $0.72 for the first 5,000 kilometres and $0.66 thereafter.

Car Allowance Or Mileage CARCROT

Mar 01, 2023 7 mins 2023 CRA Per-Kilometre Rate The 2023 CRA per kilometre rates are set at $0.68/km for the first 5,000 kilometres driven in a year, and $0.62/km after that. Mileage Reimbursement The CRA per-kilometre rate is the rate paid per kilometre driven for work related expenses.

Self Employed Mileage Allowance Explained goselfemployed.co

Tax Free Auto Allowance Rates - for use by employees - must keep an mileage log; NOT available to sole proprietors use. Employee Vehicle Expense Q&A. Business Travel Allowances - for use by employees only for meals, board and incidentals. Non-Business Travel. Simplified Vehicle Travel Rates - used for medical expenses, moving expenses, northern.

CRA Mileage Rate For SelfEmployed Canadians 2022 Guide

The Canada Revenue Agency, also referred to as CRA and the Canadian equivalent to the IRS, allows residents to deduct business mileage on a cost per kilometre basis. This is known as the CRA Mileage Rate or the Automobile Allowance Rate, and just like the U.S. Standard Mileage Rate, it is not a fixed value and can vary year to year.

Mileage Allowance A Simple Guide (UK)

The Canada Revenue Agency (CRA), which is the Canadian equivalent to the IRS, recently announced its 2020 income tax deduction limits and expense benefit rates that will apply when using an automobile for business purposes. Referred to as the Automobile Allowance Rate, this rate is not a fixed value, and just as the U.S. Standard Mileage Rate, it can change slightly year over year.

Cra Mileage Log Template HQ Template Documents

Multimedia Webinar : Automobile and Motor Vehicle Allowances Date modified: 2022-02-17 This page is for employers who provide their employees with an automobile allowance. See the related links to determine if the allowance is taxable and the necessary reporting requirements.

Car Allowance vs Mileage Reimbursement

The automobile allowance rates for 2019 were: 58¢ per kilometre for the first 5,000 kilometres driven 52¢ per kilometre driven after that In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel. The automobile allowance rates for 2018 were: 55¢ per kilometre for the first 5,000 kilometres driven

StepByStep How To Claim Motor Vehicle Expenses From The CRA In 2023

What is the 2022 CRA Allowance Rate ? The CRA Mileage Rate for 2022 has increased to the following: 61¢ per kilometre for the first 5,000 kilometres driven. 55¢ per kilometre driven after that. In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel.

Cra Mileage Log Template HQ Template Documents

In Canada, the distance allowance is generally calculated based on a per-kilometre rate, designed to reimburse the costs associated with the ownership and operation of a personal vehicle for business reasons. Annually, the CRA issues a standard per-kilometre allowance rate that organizations adopt to compensate employees for business travel.

Understanding mileage rates and automobile reasonable allowance

The Canada Revenue Agency ("CRA") has updated their per kilometre recommended reimbursement rates for 2022. This year, the CRA automobile allowance rate is ¢61 per kilometre. ¢61 is the recommended rate per kilometre for the first 5,000 kilometres driven; the recommendation is ¢55 per kilometre after that.

Cra Mileage Log Template HQ Template Documents

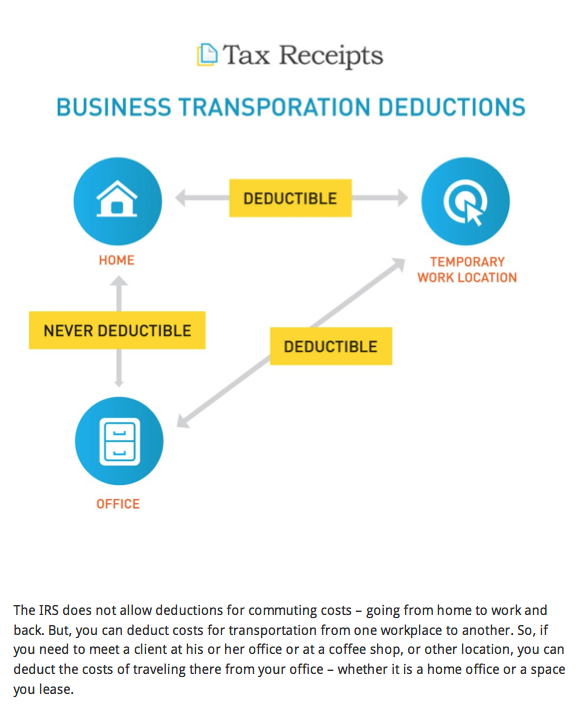

Individuals can claim any expenses incurred for operating their vehicles for business purposes to the CRA. These expenses can include fuel costs, maintenance, repairs, licenses, insurance, and certain leasing costs (additional details here ).

2020 CRA Mileage RateCanadian Automobile Allowance Rate

You are eligible to claim many types of vehicle expenses on your taxes. The types of expenses you can claim on "Line 9281 — Motor Vehicle Expenses (not including CCA)" of Form T2125 or Form T2121, or line 9819 of Form T2042 include: License and registration fees Auto insurance Fuel and oil costs Interest on money borrowed to buy a motor vehicle