Depository Trust Company (DTC) Definition, Structure, Eligibility

Depository Trust Company (DTC) Definition, Structure, Eligibility

Depository Trust Company (DTC), founded in 1973, is a New York corporation that performs the functions of a central securities depository as part of the US National Market System. DTC annually settles transactions worth hundreds of trillions of dollars, processes hundreds of millions of book-entry deliveries, and custodies millions of securities issues worth tens of trillions of dollars issued.

Depository Trust and Clearing Corporation Alchetron, the free social encyclopedia

Stock analysis for Depository Trust & Clearing Corp PAC/The (0594155D:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

Depository Trust & Clearing Corporation

THE DEPOSITORY TRUST COMPANY. STATEMENTS OF FINANCIAL CONDITION. As of December 31, (In thousands, except share data) 2022 2021 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 648,185 $ 754,890 Accounts receivable - net of allowance for credit losses 49,101 56,094 Participants' Fund cash deposits 2,001,893 1,962,667

Investor Spotlight Depository Trust & Clearing Corporation Tampa Bay Economic Development Council

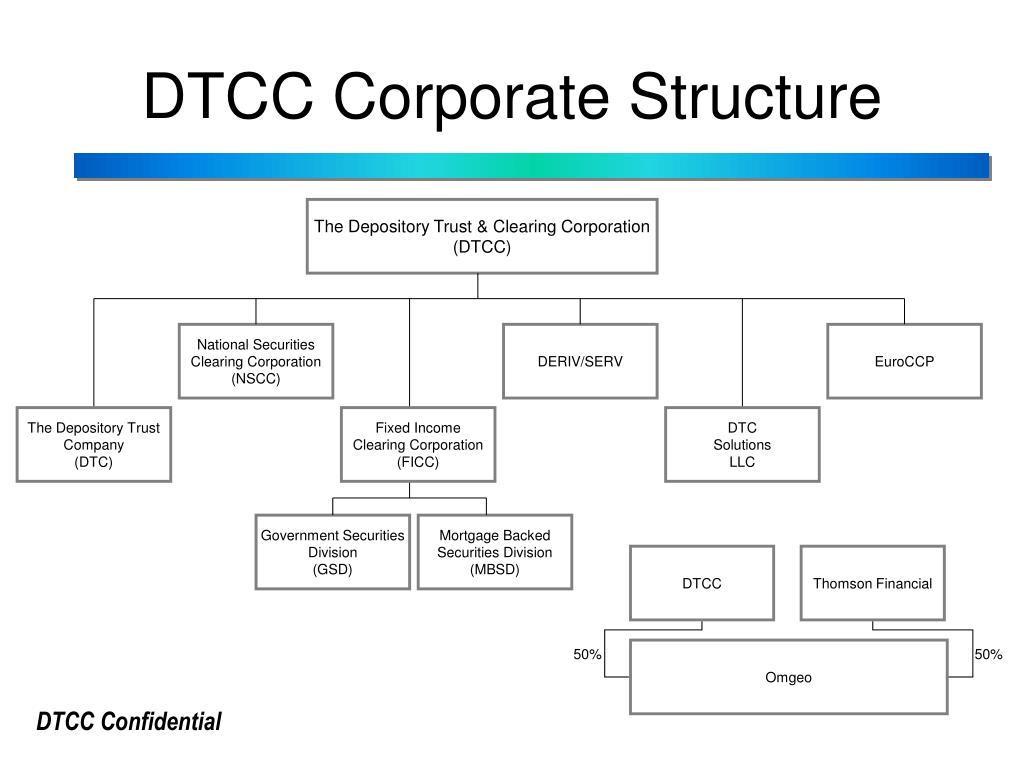

DTC Member Directories. Read how DTCC puts resilience at center of business planning. This section provides the listings of participants alphabetically by name and number for The Depository Trust Company (DTC). Use of most services provided by the regulated DTCC subsidiaries generally require membership in that subsidiary.

_Ltd.png)

Central Depository Services (India) Stock Analysis Share price, Charts

The iShares Bitcoin Trust seeks to reflect generally the performance of the price of bitcoin. The iShares Bitcoin Trust is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940.

:max_bytes(150000):strip_icc()/inv-best-of-template-1-5c54764946e0fb00013a21a0.jpg)

Depository Trust Company (DTC) Definition

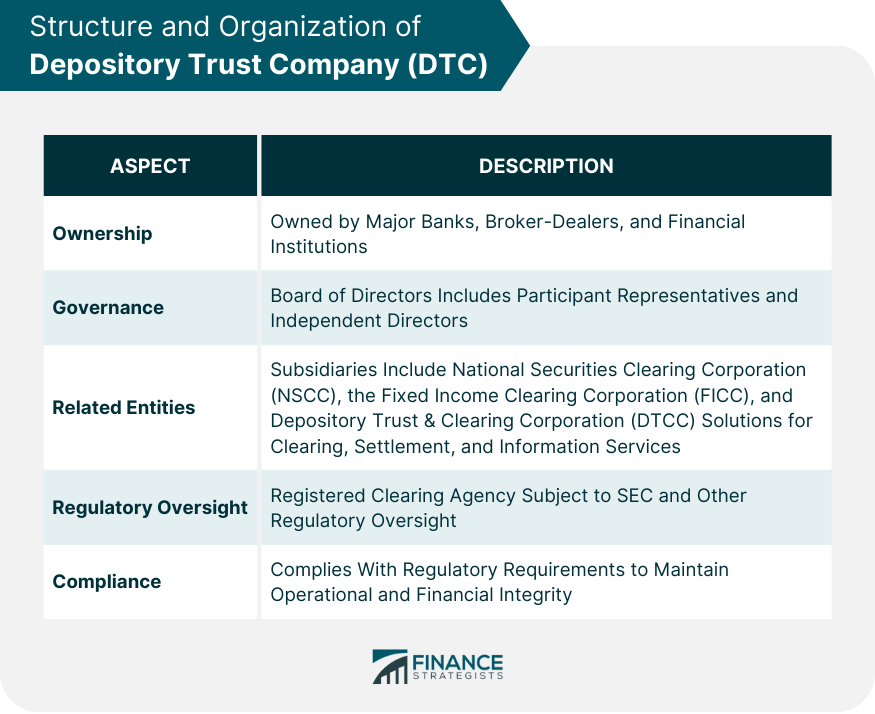

The Depository Trust Company (DTC), a US-based corporation, is a central securities depository accepting deposits from over 65 countries. It provides book-entry and depository services, transfer and pledge of securities, operates a settlement system for securities, and also performs associated income distributions.

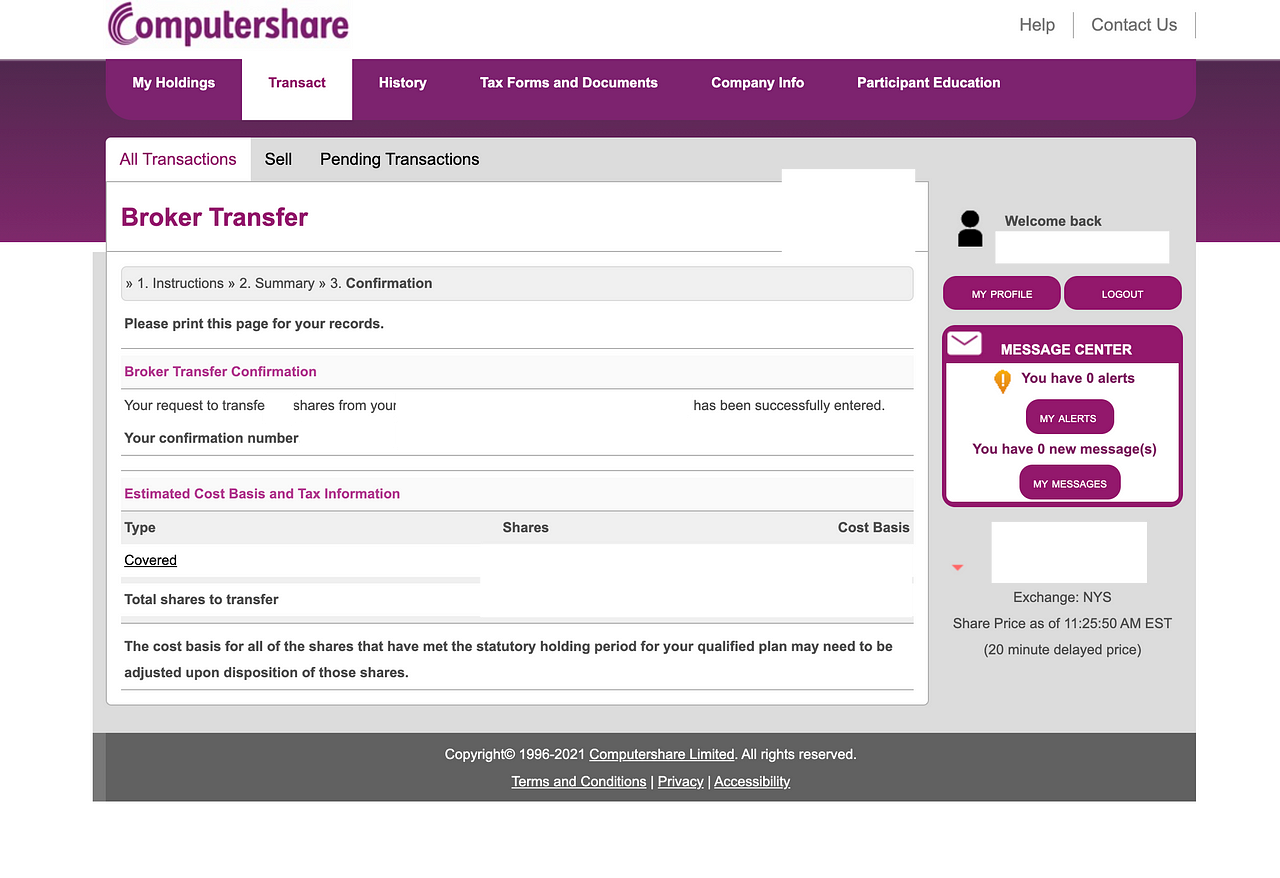

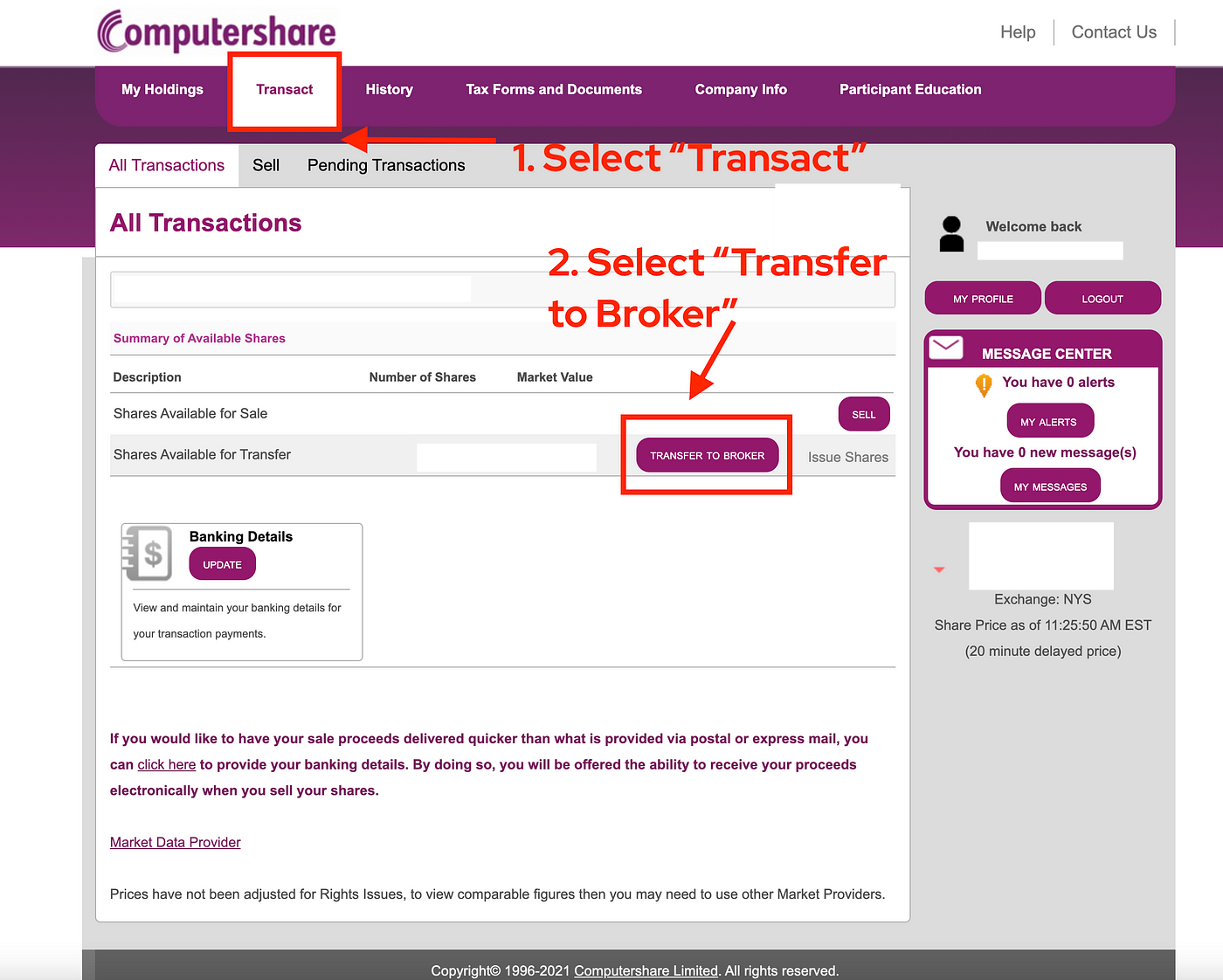

How to transfer your stocks to your broker with DTC (Depository Trust Company) code by Bryant

When an investor holds shares this way, the investor's name is listed on its brokerage firm's books as the beneficial owner of the shares. The brokerage firm's name is listed in DTC's ownership records. DTC's nominee name (Cede & Co.) is listed as the registered owner on the records of the issuer maintained by its transfer agent.

Depository Trust and Clearing Corporation (DTCC) Advancing Financial Markets using Distributed

The Depository Trust Company (DTC) subsidiary has custody of and provides asset servicing for millions of securities issues of issuers from the U.S. and over 60 other countries. DTC serves as a.

How to transfer your stocks to your broker with DTC (Depository Trust Company) code by Bryant

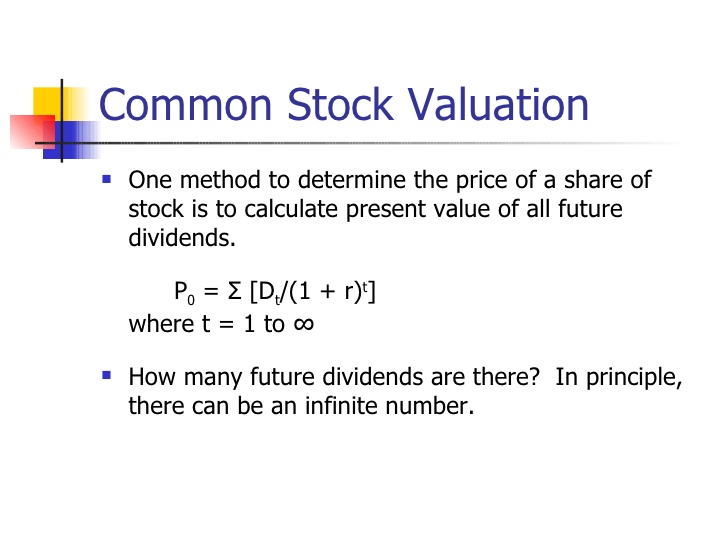

The limit order price cap is dynamic and changes with fluctuations in share prices. Thus, if the market price increases to $12, the maximum limit order price will increase to $84.. The Depository Trust Company (DTC) is a repository through which stocks are transferred electronically between brokers and agents. It provides electronic.

PPT DTCC Governance PowerPoint Presentation, free download ID5259046

Depository Trust Company Tracking - DTCT: A service, used by underwriting firms, that provides a method of tracking the exact path of purchases and sales of newly issued securities.

Depository Trust Company (DTC) Overview, How It Works,

The Depository Trust and Clearing Company (DTCC), a holding company, owns the DTC. The company manages book entry securities transfers. It also provides custody services for stock certificates.

PPT Depository Trust & Clearing Corporation PowerPoint Presentation ID3104172

Depository Trust Company , founded in 1973, is a New York corporation that performs the functions of a central securities depository as part of the US National Market System. DTC annually settles transactions worth hundreds of trillions of dollars, processes hundreds of millions of book-entry deliveries, and custodies millions of securities issues worth tens of trillions of dollars issued in.

What is the 'Depository Trust Company DTC

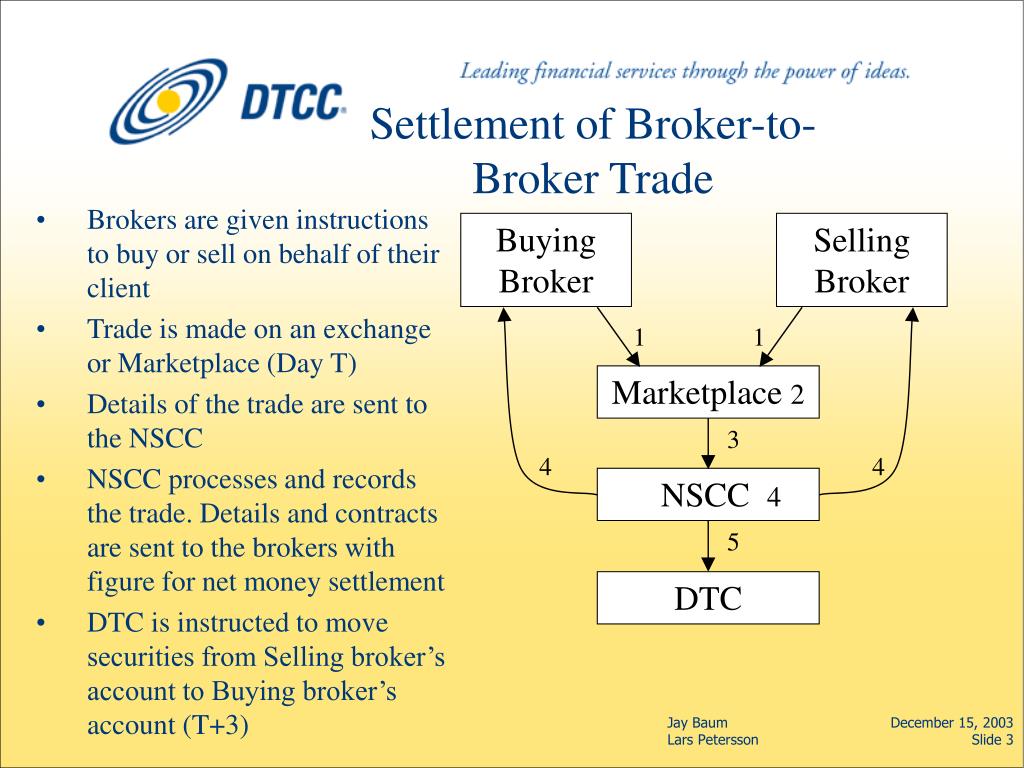

The Depository Trust & Clearing Corporation (DTCC) is an American post-trade financial services company providing clearing and settlement services to the financial markets.It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.. DTCC was established in 1999 as a holding company to.

The Depository Trust Company Dtc's Formative Years and Creation of the Deposito 9780980050851

THE DEPOSITORY TRUST COMPANY STATEMENTS OF FINANCIAL CONDITION (UNAUDITED) As of March 31, As of December 31, (In thousands, except share data) 2022 2021 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 629,688 $ 754,890 Accounts receivable - net of allowance for credit losses 55,148 56,094 Participants' Fund cash deposits 1,974,905 1,962,667

How to transfer your stocks to your broker with DTC (Depository Trust Company) code by Bryant

The Depository Trust Company (DTC) is a crucial entity in the financial industry, offering services such as securities settlement, safekeeping, and asset servicing. It was established in 1973 as a subsidiary of the Depository Trust & Clearing Corporation ( DTCC ), the largest securities depository and clearing corporation worldwide.

How Is a Company's Share Price Determined? India Dictionary

Depository Trust Company - DTC: The Depository Trust Company (DTC) is one of the world's largest securities depositories. The DTC, which was founded in 1973 and is based in New York City, is.