Common Payroll errors and how to avoid them. TaxBoox

But don't worry too much yet. We'll go over all the most common mistakes and how to avoid them. . So without further ad, here are the top seven payroll errors and their fixes: 1. Misclassifying Workers. Before you add employees to your payroll, you need to classify your business relationship with them.

5 Common Payroll Mistakes To Avoid Best Employer Solutions

6 common payroll errors and their solutions. 1. Misclassifying employees as independent contractors (and vice versa) When you hire someone, you need to classify them as an employee or an independent contractor. This distinction determines whether you tax their wages.

Common Payroll Mistakes What They Are & How to Avoid Them

Without further ado, here are eight payroll mistakes to avoid at all costs. 1. Misclassifying Employees. Part of your role as "employer" is determining if a worker is a contractor (1099) or.

5 Common Payroll Mistakes and How to Avoid Them

Your payroll solution should have features to help you avoid payroll mistakes. Here are some of the most common payroll errors that companies make. Incorrect Tax Forms. Your employee uses their W-2 and any other company-issued tax form to pay their income taxes. Any mistake here will cause problems for the company and the employee.

Fuse Workforce Management on LinkedIn The 7 Most Common Payroll Errors

Full-time vs. part-time employees and whether or not the employee is part of a union may mean their pay is governed by different rules as well. 8. Disorganized records. Payroll records need to be organized properly so that you can file at the right time and so your employees get paid promptly.

5 Common Payroll Mistakes That Are Totally Avoidable Poprouser

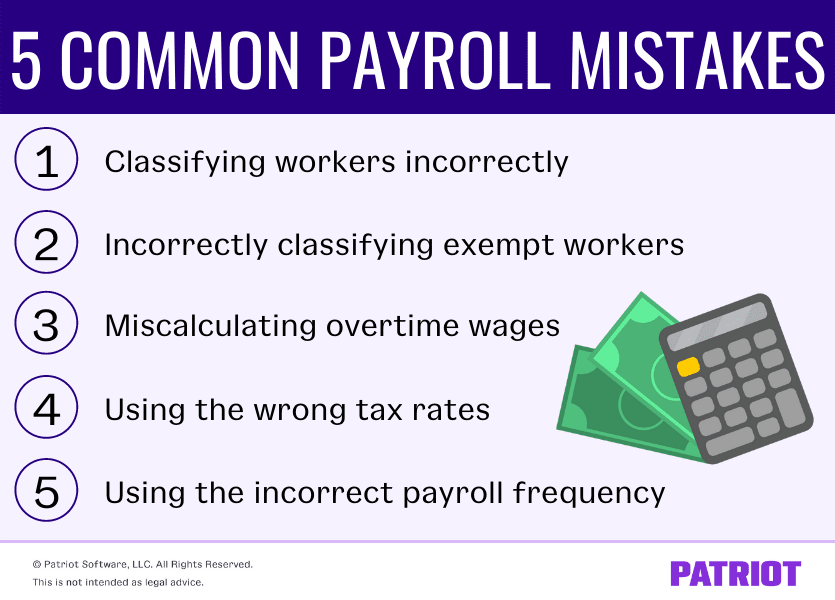

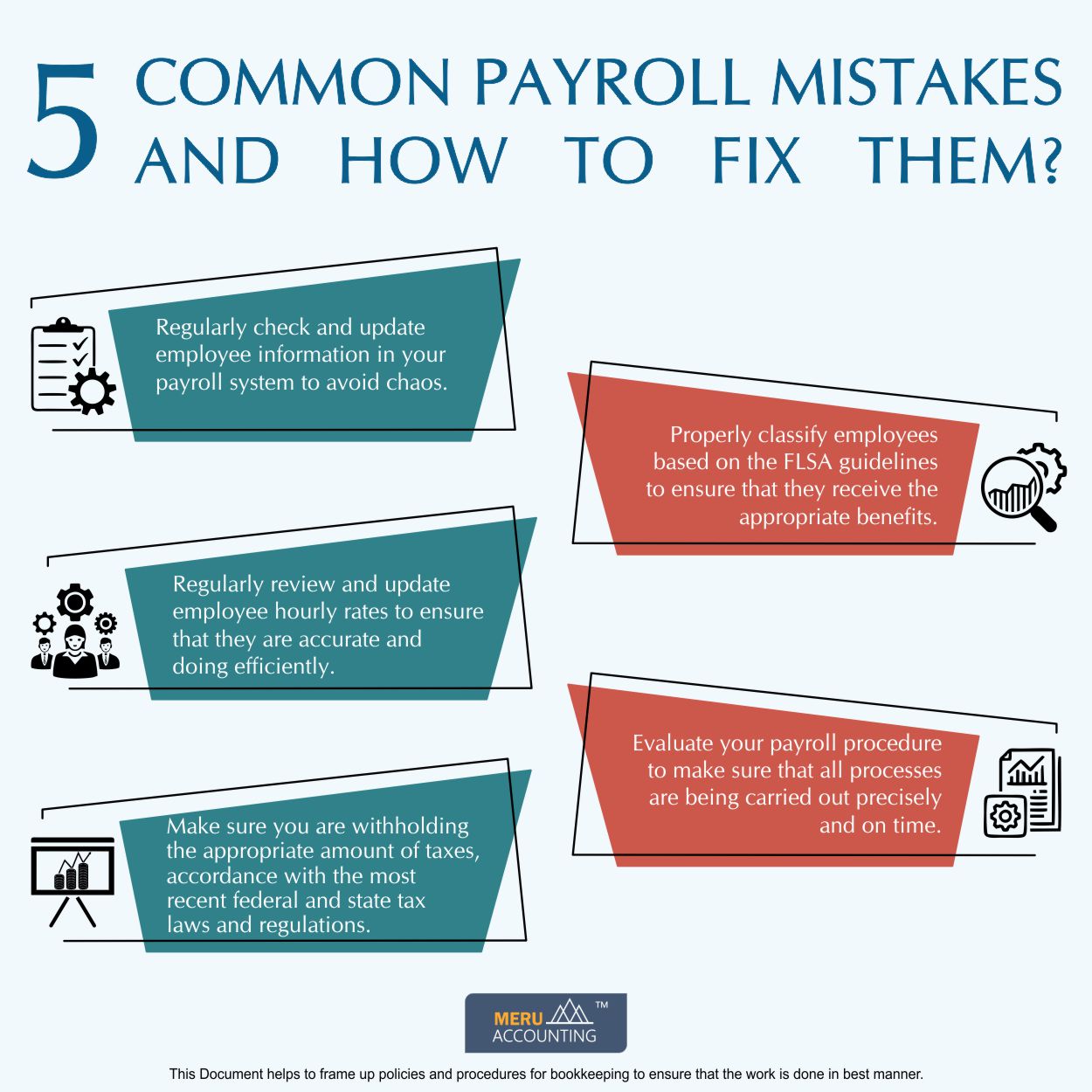

5 most common payroll mistakes. By making yourself aware of the most common mistakes made in payroll, you can go some way to avoid making them in the first place. 1. Misclassification of employees. By incorrectly attributing worker status, your organisation could face legal action from employees, substantial back taxes and fines or penalties.

Top 05 Common Payroll Mistakes and How to Fix Them?

Your business can avoid all of these payroll mistakes by adhering to the following best practices: Create a calendar with reminders for important dates (e.g., pay periods and paydays, quarterly taxes, W-2 deadline, etc.). Conduct a quarterly audit or review of your payroll process to determine areas for improvement.

Infographic How to Avoid the Most Common Payroll Mistakes ZenHR Blog

Some potential payroll tax mistakes are: Late filing of taxes - The Indian income tax authority gives a due date for filing the taxes, and missing this deadline can attract a penalty and late fee. Human errors - Incorrect figures/totals and improperly filling up the tax forms can lead to inaccurate remittance.

5 common payroll implementation errors you can easily avoid Zenith

5 tips to avoid common payroll mistakes: 1. Check employee details for accuracy. Ensure the below details are up to date for employees: Tax file number. Full name and address. Start date or termination date of employee. Date of birth. Pay details such as gross wage, allowances, hourly rate, employment period.

Common Payroll Mistakes, Consequences and How to Avoid Them

Incorrectly remitting wage garnishments. Not calculating overtime correctly. Calculating bonus and commission taxes incorrectly. Not keeping correct payroll records. Paying employees on the wrong.

5 Common (and Costly) Payroll Errors and How to Avoid Making Them

Payroll apps can prevent payroll mistakes (and potential future litigation concerns) by providing tools for employees to communicate with you about their work hours, requests and any inaccuracies they spot. Time and attendance tools also let your employees review and verify their work hours when they clock in and out. .

How to Avoid the Most Common Mistakes When Managing Payroll Chuck's

However, costly payroll mistakes do occur and some might be more common than you may realize. Read on to learn more about common payroll mistakes and what business owners can do to avoid them. The Importance of Accurate Payroll. Avoiding payroll mistakes is important for many reasons. First and foremost, payroll mistakes can be costly.

Are You Making These 5 Common Payroll Mistakes? (Plus Best Practices

15. Not Checking Credentials when Outsourcing Payroll. How To Reduce Your Risk. 1. Improperly Categorizing Employees as Independent Contractors. One of the biggest payroll mistakes that you can make is improperly categorizing an employee ( Tax Form W-2) as an independent contractor ( Tax Form 1099 ), or vice versa.

Top 5 Most Common Payroll Mistakes

Ensure you meet all deadlines for submitting payroll-related reports, such as PAYG withholding, Single Touch Payroll (STP) reporting, and Payment Summaries (Group Certificates). Double-check the information you provide to avoid errors that may lead to compliance issues. Avoiding common payroll mistakes is essential for Australian employers to.

5 Common Payroll Errors and How to Avoid Them Mental Itch

Here are some of the most common payroll errors to watch for in your company. 1. Misclassifying Employees. The Fair Labor Standards Act (FLSA) provides benefits and protections, like overtime pay and minimum wage, for most employees. Independent contractors, however, are not afforded these same protections.

How to Avoid the Most Common Payroll Mistakes at All Costs The PK Times

One of the best ways to prevent missing paid time off is to use automated timekeeping and ensure employees have access to their payroll portal and can request time off. This can prevent any mistakes or missed paid time off. Not Asking Your Rep Questions. At Infinium, we have a saying: Anything "outside the circle" of everyday payroll, be.